The interest in casual dining has been growing since the very first outlets opened their doors in the 1920s. The draw? Inexpensive menus, quick service and convenience. Fast forward 100 years and the quick service restaurant (QSR) industry has evolved to become a household fixture.

In Australia, it’s now worth $21 billion with consumers spending more than a third of their household food budget on casual dining and eating out. In New Zealand, it’s a similar story with the QSR market share sitting at $3.2 billion.

While the industry has held its own during the past few turbulent years, the COVID-19 pandemic also brought some serious competition into the market. More people began cooking at home, and takeaway was suddenly available through delivery apps from restaurants more traditionally focused on dining in. Because of these new trends, QSR operators need to be on top of their game to remain competitive by staying on brand, being innovative and continuing to ensure high food and cleaning standards.

So, what’s at the top of the list for QSR businesses looking to remain competitive local and global players?

RAISING THE CUSTOMER EXPERIENCE BAR

For many consumers, their first memories of eating out are at quick service restaurants. Whether it’s tucking into a Happy Meal or indulging in a freshly baked cookie, these childhood experiences form the expectations of adult customers. But since the pandemic, service expectations have risen.

Consumers are no longer as patient as they once were, with less than efficient service sending people out the door. In fact, 76% of consumers will leave an establishment if they see a long line. To keep lines moving, new technology innovation – such as the use of QR code ordering and self-service kiosks – can help reduce service wait times and better please the palates and patience of customers.

It’s a trend Michael Locke, National Business Development Manager at Bunzl, is witnessing across the industry. “Even after most COVID-19 restrictions were lifted, the popularity of self-service ordering hasn’t diminished.”

Aside from improving service wait times, new technologies and industry innovations are assisting QSRs in tackling the labour shortage felt across Australia and New Zealand. With consumers taking care of their own orders via self-service and QR codes, the number of front of house employees can be reduced and kitchen production staffing resources streamlined.

KEEPING IT CLEAN

Before focusing on innovating the customer experience, QSRs need to first invest in implementing the right solutions at the back end. Food safety has always been a priority in the QSR industry, and COVID brought a sharp focus on the need to maintain stringent hygiene standards.

Investing in cleaning products and properly fitting personal protective equipment (PPE) can help restaurants maintain attention to detail when it comes to disinfecting high-touch areas. This showcases a commitment to creating a cleaner, safer place to dine.

For example, the use of gloves when preparing food is not new in the QSR industry, but wearing gloves to perform other functions is now a customer expectation, especially when people are handling food containers and equipment.

LEVERAGING THE SUPPLY CHAIN

Locke says knowing the way around a business’s supply chain is a priority for QSR operators. This includes maintaining long-term supplier relationships to engineer mutual value, rather than merely exchanging it. “Today’s QSR is a multifaceted and complicated business, which is why having the right support expertise is crucial to operating a profitable restaurant. By strategically partnering with the right supplier, QSRs can ensure they have sufficient supplies and establish brand consistency.”

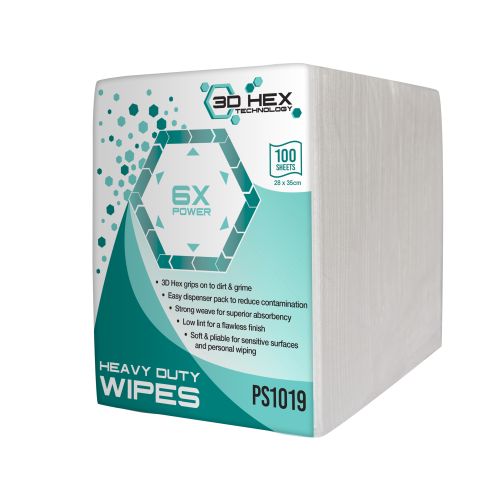

Knowledge of products, such as gloves, bin liners and wipes, also ties into efficient supply-chain management. Educating staff around correct usage can bring cost savings in the long term. It ensures products and equipment last longer, and prevents wastage. “When you use the products in the correct way, your processes will naturally become more efficient – this is the key of correct-use rate. Products and stock will last longer when they’re used sustainably and in the right way,” Locke says.

For an industry that is predicted to grow globally from USD $973 billion in 2021 to USD $1,467 billion by 2028, making smart choices now to stay abreast of current trends will see QSR operators enjoying another hundred years of service.